Get the quote details if you have applied before. Applied Before? Resume Application

UIN: 138N084V02 ADVT No. II/Oct 2024/7247

What is Life Insurance?

Life insurance is your family's financial safety net, offering peace of mind and security. When you buy life insurance, you agree to pay regular premiums, and in return, the insurer promises to pay a designated beneficiary a specified amount upon your death. This payout, known as the death benefit, helps provide financial stability for your loved ones in your absence.

How to Buy the Right Life Insurance Plan for You?

- Assess Your Needs: Look at your financial and life goals to decide the type of life insurance product you need to buy.

- Determine Coverage Amount: Opt for a sum assured that covers at least 10-15 times your annual income.

- Compare Plans: Evaluate policies based on coverage, benefits, and premiums.

- Check Claim Settlement Ratio: Choose a reliable insurer with a high claim settlement ratio.

- Add Riders: Consider additional benefits the plan has to offer at a nominal cost.

Who is Eligible to Buy a Life Insurance Policy?

Life insurance is accessible to a broad range of individuals:

Age Group

Life insurance is generally available to those aged 18-65. However, it may vary according to the policy.

Citizenship

Usually all citizens or permanent residents of the policy issuing country can buy a life insurance policy.

Other Factors

Eligibility also depends on your occupation, education, lifestyle, and financial status.

Special Considerations

Smokers

Can buy life insurance but at higher premiums.

Disabled Individuals

Terms and premiums depend on the disability.

Individuals With Health Issues

People who have diabetes heart disease, hypertension etc., can still buy life insurance, but at higher premiums.

Talk to our Expert advisors to learn more

Check your premiums today! (no personal details asked)

Why Buying Life Insurance Online is a Smart Choice?

Discounts

While buying life insurance online, you can save money. For example, Bandhan Life’s iTerm Prime offers up to 10% discount+ on online term insurance.

Convenience

Compare policies, calculate premiums and buy life insurance from the comfort of your home. Bandhan Life's digital process is quick and easy.

Customization

Include benefit riders like accidental death` cover to personalize your life insurance policy. This offers more coverage at a nominal cost.

Fast Process

Minimal paperwork and no medical exams## for certain policies make buying life insurance quick and efficient.

Bandhan Life provides a seamless online experience with discounts and customizable options. Secure your family’s future easily with Bandhan Life.

What is the Ideal Life Insurance Coverage Amount?

- Income Replacement: Your life insurance cover should replace your income. While buying life insurance, aim for a life cover that's 10-15 times your annual income to cover living expenses.

- Debts: Your life insurance cover should be enough to pay off outstanding debts like home loans, car loans, and credit card debts.

- Financial Goals: When deciding on the life insurance cover, factor in long-term goals like children’s education, marriage, and retirement plans.

- Existing Coverage: If you already have other life insurance policies, review them. Include all employer-provided insurance as well. Ensure your total coverage is comprehensive.

What Are The Benefits of Life Insurance Plans

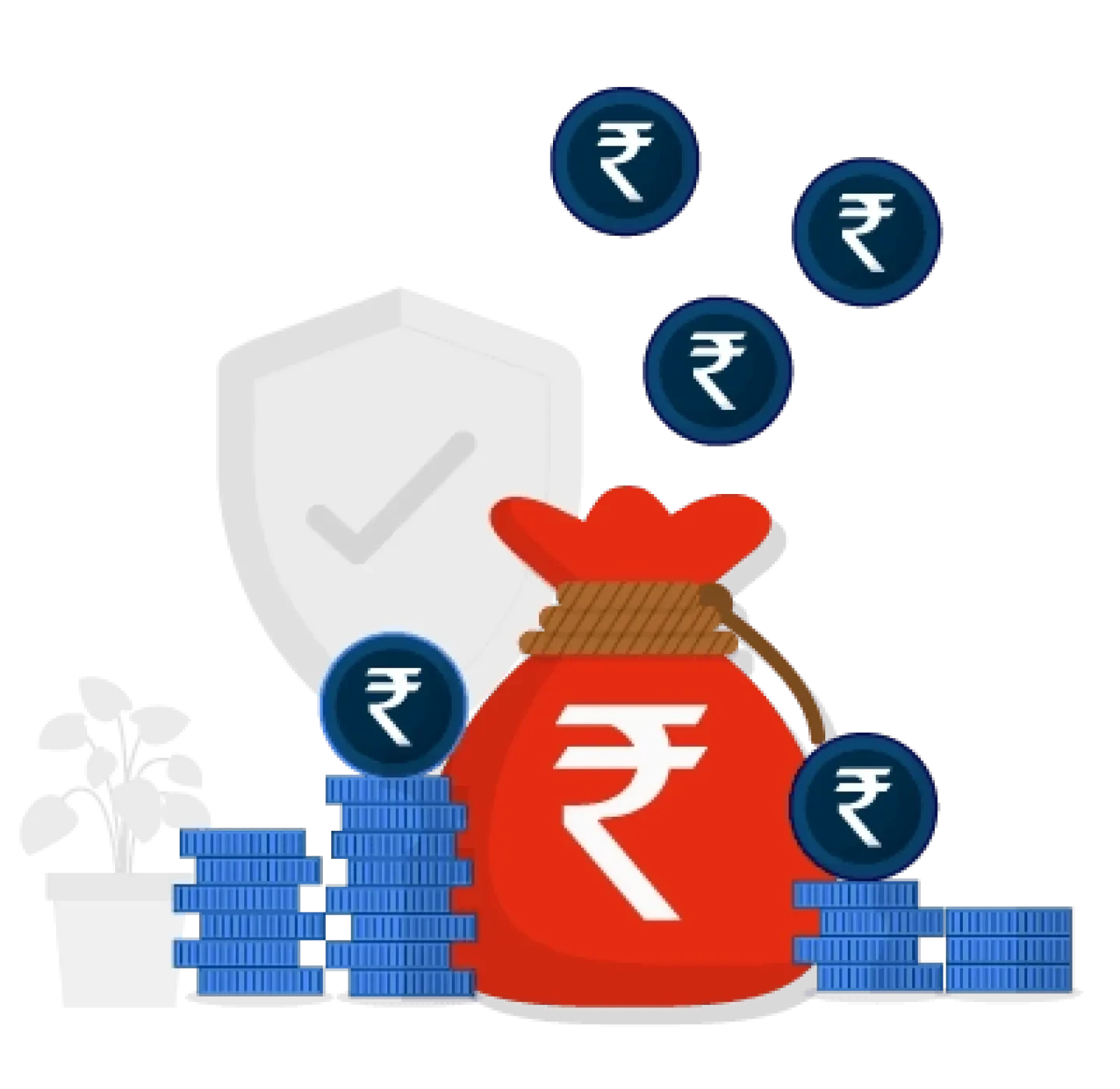

Tax Benefits%

Premiums are tax-deductible up to ₹1.5 lakh annually under Section 80C. Maturity benefits and death claims are tax-exempt under Section 10(10D).

Online Discounts+

Online purchases often come with discounts, such as Bandhan Life’s iTerm Prime offering up to a 10% discount+.

Loan Collateral

Use life insurance as collateral for loans, securing lower interest rates.

Financial Support

Provides financial security for your family in your absence, covering daily expenses, debts, and future goals.

Additional Benefits

Riders like accidental death benefit` enhance your policy’s protection.

How Can You Find the Perfect Life Insurance Policy for Your Family?

- Goals: Identify your financial goals, such as funding your children’s education, securing your spouse's retirement, or maintaining your family’s lifestyle. Choose a policy that aligns with these objectives.

- Age: Your age affects the type of policy you need. Younger individuals might prefer term insurance for affordability, while older individuals might choose whole life or endowment plans for lifelong coverage and savings.

- Financial Liabilities: Evaluate your current and future financial obligations, like mortgages, personal loans, and education expenses. Ensure your policy covers these debts to prevent financial stress on your family.

- Regular Income: Consider your income and job stability. Choose a policy that matches your income level and provides adequate coverage to replace your income.

- Remaining Working Years: Calculate the number of working years left before retirement. Ensure your coverage extends until then, protecting your family throughout your earning years.

A rider is an additional benefit you can add to your basic life insurance policy for extra coverage. Common types of riders include

Provides a lump sum payment if diagnosed with a serious illness like cancer or heart disease

Offers an additional payout if the policyholder dies in an accident

Get a ₹5 lakh Accidental Death benefit rider for just ₹20 a month2.

Waives future premiums if you become disabled and can’t work.

What are the Important documents Required to Buy a Life Insurance Plan?

There are some important documents you must keep handy while buying life insurance

PAN Card:Your PAN is a must for your KYC, if you want to buy the best life insurance plan online. We can confirm your identity and even verify your income with just this one document.

Aadhar Card:We ask for your Aadhar only when your eKYC is unsuccessful using your PAN. We recommend using your Aadhar to complete the KYC process.

Driving License:Your driving license is another document you can use to complete your KYC.

Income Proof:Keep your bank details, salary slips, bank statements, ITR just in case we need them for income verification.

Medical History/Diagnosis Reports:We will conduct a medical verification, but we might need your old medical reports to verify.

Life insurance not only secures your future but also offers tax benefits. Here's how:

Tax Deductions on Premiums Paid

Under Section 80C of the Income Tax Act, premiums up to ₹1.5 lakh annually are deductible. This applies to policies for yourself, your spouse, or your children.

Tax-Free Payouts

Maturity proceeds or death benefits are tax-exempt under Section 10(10D), provided premiums don’t exceed 10% of the sum assured for policies issued after April 1, 2012 and the premium does not exceed Rs. 5 Lacs for policies issued on or after 1 April 2023.

Tax Benefits on Riders

Riders like accidental death benefit qualify for deductions under Section 80D, reducing your taxable income further.

Savings on Estate Tax

Life insurance payouts aren’t subject to estate tax, ensuring maximum benefit to your beneficiaries.

Why Choose Bandhan Life Insurance?

Bandhan Life offers plans that secure your family's future and provide significant tax savings.

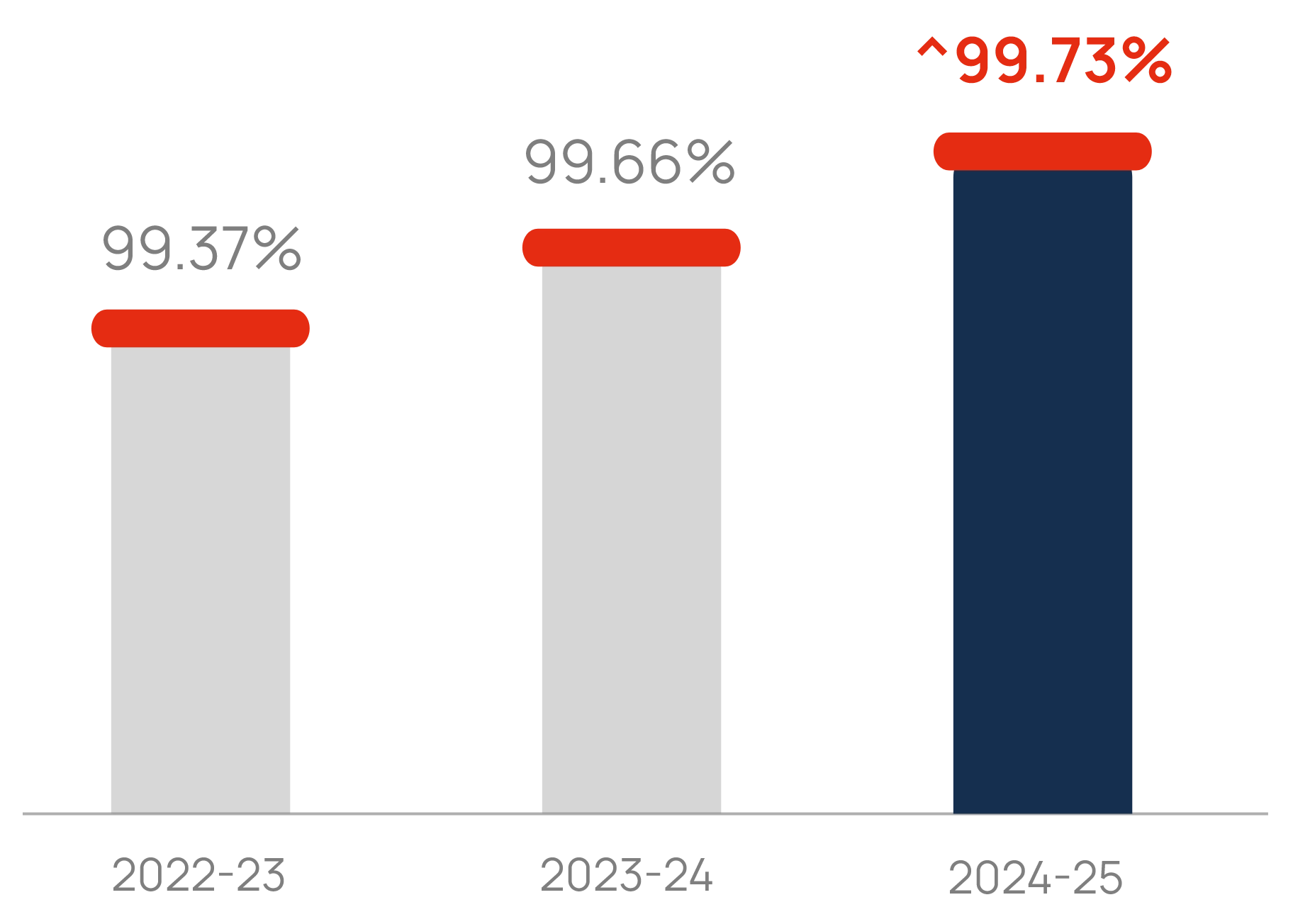

We Keep Our Promises!

How to Ensure Your Claims Are Settled?

How to File a Claim

Visit the Bandhan Life claim process page and fill out the online claim form.

Send an email to claims@bandhanlife.com with the details of your claim

Visit our nearest Service Center. Locate Now

Call the Bandhan Life customer care number and follow the instructions.bandhan

Documents Required

Filled and signed by the claimant.

Original policy document.

Issued by the municipal government.

Aadhar card, PAN card, passport, etc.

Hospital discharge summary, medical reports.

Claimant’s bank passbook or cancelled cheque.

In case of accidental death claims.

"Bandhan Life promises a smooth and efficient claim process."

Preventing Rejection of Life Insurance Claims

Ensure your nominee’s claim is not rejected by following these tips

Provide Accurate Information

Ensure all information during application is accurate and truthful.

Ensure Premiums are Paid on Timew

Timely payments keep your policy active, avoiding lapses in coverage.

Keep Beneficiaries Informed

Make sure your beneficiaries know the policy details and claims process.

Maintain Comprehensive Records

Keep all policy documents and receipts safe and accessible.

Submit Complete Documentation

Ensure all required documents are submitted correctly and completely.

Regularly Review Your Policy

Update your policy details periodically, including beneficiary designations.

What to do if Your Claim is Rejected

Understand the Reason

Review the rejection letter to understand why.

Contact the Insurer

Reach out to Bandhan Life’s customer service for clarification.

Submit an Appeal

If unjustly rejected, submit an appeal with documentation.

Seek Legal Advice

Consult a legal advisor if necessary.

"Bandhan Life is here to support you every step of the way."

Explore Life Insurance Plans from Bandhan Life

iInvest Advantage

Fuel Your Wealth, Protect Your Future

iTerm Prime

An affordable term plan for your family's protection.

iTerm Comfort

A solid term insurance plan for everyone

Saral Jeevan Bima

An affordable term plan for your family’s protection.

FAQs About Life Insurance

Here are some frequently asked questions about life insurance

Why do I need life insurance?

Life insurance provides financial protection to your loved ones in case of your untimely demise. It ensures that their financial needs are met, covering expenses like loans, education, and daily living.

What are the different types of life insurance?

The main types of life insurance include term insurance, whole life insurance, endowment plans, and unit-linked insurance plans (ULIPs). Each serves different needs—protection, savings, or investment.

Should I buy a term plan or a savings insurance plan?

A term plan is cost-effective with pure protection and a larger life cover, while savings insurance plans offer both coverage along with savings and guaranteed returns. Make a decision based on your life goals, savings, investments, assets, debts, and liabilities.

What kind of deaths are not covered in term insurance?

Deaths due to suicide within the first year, involvement in criminal activities, and death from dangerous hobbies like skydiving may not be covered. It's important to check the policy exclusions for specifics.

Can senior citizens buy term insurance?

Yes, senior citizens can buy term insurance, though options may be limited based on their age and health. Premiums for senior citizens are generally higher, and coverage might have restrictions.

What is the minimum & maximum age to buy life insurance?

The minimum age is typically 18 years, and the maximum is around 65 years, depending on the insurer. Some insurers may offer plans to individuals up to 70 years with different terms.

Can a minor be appointed as a nominee in life insurance?

Yes, but a guardian must be appointed to manage the claim until the minor reaches the age of 18. The guardian will ensure that the benefits are used in the best interest of the minor.

Is life insurance premium paid monthly?

Yes, you can choose to pay premiums monthly, quarterly, half-yearly, or annually, depending on your convenience. Some insurers may offer discounts for paying premiums annually.

How do you calculate life insurance premiums?

Premiums are based on several factors like your age, health, policy term, sum assured, and lifestyle choices such as smoking. The higher the risk you pose, the higher the premium you'll pay.

Will my life insurance lapse if I stop paying the premiums?

Yes, if premiums are not paid within the grace period, typically 30 days, the policy will lapse. However, some policies may offer reinstatement options if payments are resumed within a specified period.

BEWARE OF SPURIOUS PHONE CALLS AND FICTIOUS/ FRAUDULENT OFFERS!

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

iTerm Prime -

Bandhan Life iTerm Prime (UIN: 138N084V02). A Non-Linked Non-Participating Individual Pure Risk Premium Life Insurance Plan. Life insurance cover is available under this product. Life cover is benefit payable on the death of the life assured during the policy term. For more details on risk factors, terms & conditions please read sales brochures and benefits illustrations carefully before concluding a sale. Insurance Issuance is subject to board approved underwriting policy.

[+] Up to 10% Discount: 5% discount will be applicable only on first year premium for online customers. Additional 5% discount will also be applicable only on first year premium for Self-Employed or other Non-Salaried Customers.

[#] Zero Documentation: Zero Documentation is Subject to board approved underwriting policy.

[^] Claim Settlement Ratio: Individual Death Claim Settlement Ratio for Bandhan Life Insurance Limited for FY 2024-25 is 99.73% as per annual audited figures.

[&] Special Exit Value: On availing Special Exit Value (SEV), total of premiums paid, along with underwriting extra premiums paid, plus loadings for modal premiums (if any) will be paid back to the insured, and the policy will terminate. Here, total premium paid is the total of all the premiums received, excluding any extra premium, any rider premium, and taxes. SEV is applicable only to base cover premium, and not to any additional optional riders. SEV is available for policies where age of insured at inception of the policy is up to 40 years (as of last birthday), and the policy matures at the age of 70 years (as of last birthday) and can be availed during the period of one year once they attain age of 55 years (as on last birthday). For more details on SEV and risk factors, please read the sales brochure carefully before concluding a sale.

[##] In case of any observations during Video Medicals, physical medicals will be required and premiums rates may vary. Home visits are subject to availability in your location.

[%] Tax Benefit: All tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you and are applicable only if all due premiums are paid and the policy being in force on the date of maturity. Avail Tax Benefits under Section 80C and 10(10D) and other provisions of the Income Tax Act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax benefits and tax laws are subject to amendments made thereto from time to time. Please consult your tax advisor for details, before acting on above. The Company does not assume responsibility on tax implication mentioned anywhere in this page. It is recommended to obtain professional advice for applicability of tax benefits.

[`] Rider Benefits: Bandhan Life iTerm Prime offers add-on optional coverages through the choice of the below mentioned riders provided their Premium Payment Term and Policy Term are consistent with that of the base plan:

1)Bandhan Life AD Rider (UIN: 138B006V05 and all succeeding versions) – Provides a Lump-sum benefit equal to the rider Sum Assured in case of death due to accident of the Life Assured.

[2] The monthly instalment premium Rs.20 for Bandhan Life AD rider has been calculated for a cover of 5 Lakhs for a salaried, healthy male, non-smoker, aged 30 years, for insurance coverage up to 70 years of age and for premium payment term of 40 years. This premium value is exclusive of taxes, and any online discount and Annualised premium is Rs.225.

Please refer the sales brochure of the respective riders to understand the benefits and terms & conditions before concluding the sale.

iTerm Comfort -

Bandhan Life iTerm Comfort (UIN: 138N082V01) is a Non-Linked Non-Participating Individual Pure Risk Premium Life Insurance Plan. For more details on risk factors, terms & conditions please read sales brochures and benefits illustrations carefully before concluding a sale. Life insurance cover is available under this product. Insurance Issuance is subject to board approved underwriting policy.

[&] Special Exit Value: On availing Special Exit Value (SEV), total of premiums paid, along with underwriting extra premiums paid, plus loadings for modal premiums (if any) will be paid back to the insured, and the policy will terminate. Here, total premium paid is the total of all the premiums received, excluding any extra premium, any rider premium, and taxes. SEV is applicable only to base cover premium, and not to any additional optional riders. SEV is available for policies where age of insured at inception of the policy is up to 40 years (as of last birthday), and the policy matures at the age of 70 years (as of last birthday) and can be availed during the period of one year once they attain age of 55 years (as on last birthday). For more details on SEV and risk factors, please read the sales brochure carefully before concluding a sale.

[%] Tax Benefit: Tax benefit of ₹ 46,800 is calculated at highest tax slab rate of 31.2% (including cess excluding surcharge) on life insurance premium u/s 80C of ₹1,50,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(D), 115BAC and other provisions of the Income tax act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. The Company does not assume responsibility on tax implication mentioned anywhere in this page. It is recommended to obtain professional advice for applicability of tax benefits.

[#] Zero Documentation: Zero Documentation is Subject to board approved underwriting policy.

Saral Jeevan Bima-

Bandhan Life Saral Jeevan Bima (UIN: 138N077V01), is a non-linked non-participating individual pure risk premium life insurance plan. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale. Life insurance cover is available under this product. Insurance Issuance is Subject to board approved underwriting policy.

[@] The premium for an 18 year-old healthy female for a life cover of ₹ 5 lacs for a policy term of 20 years, is ₹ 163 p.m. assuming that all premiums (excluding applicable taxes, cesses and levies and rider premiums, if any) have been paid as and when due. The annualized premium for above parameters will be Rs. 1,874 p.a.

iG Vishwas -

Bandhan Life iGuarantee Vishwas (UIN: 138N096V02). is a Non-linked Non-Participating Life Insurance Individual Savings Plan. Life insurance cover is available under this product. Life cover is benefit payable on the death of the life assured during the policy term. For more details on risk factors, terms and conditions, please read the sales brochure and benefits illustrations carefully before concluding a sale.

[!] The return has been on a annualized premium for a 30 years old, healthy male, for an annualized premium premium of ₹60,000 for a PT of 20 years and PPT 8 years, provided that all premiums (excluding applicable taxes, cesses and levies) have been paid as and when due and the policy is in force till maturity.

[%] Tax Benefit: Tax benefit of ₹ 46,800 is calculated at highest tax slab rate of 31.2% (including cess excluding surcharge) on life insurance premium u/s 80C of ₹1,50,000. Tax benefits under the policy are subject to conditions under Section 80C, 80D, 10(D), 115BAC and other provisions of the Income tax act, 1961. Goods and Services Tax and Cesses, if any, will be charged extra as per prevailing rates. Tax laws are subject to amendments made thereto from time to time. The Company does not assume responsibility on tax implication mentioned anywhere in this page. It is recommended to obtain professional advice for applicability of tax benefits.

[$] Guaranteed benefits are available only if all premiums are paid as per the premium paying term and the policy is in-force till the completion of entire policy term opted. For more information on guaranteed returns & guaranteed addition, please refer to the product brochure.

iGuarantee Max Savings -

Bandhan Life iGuarantee Max Savings(UIN: 138N083V03) is a Non-linked Non-Participating Life Insurance Individual Savings Plan. Life insurance cover is available under this product. For more details on risk factors, terms and conditions, please read the sales brochure and benefits illustrations carefully before concluding a sale. Issuance is subject to board-approved underwriting policy. Guaranteed benefits are available only if all premiums are paid as per the premium paying term and the policy is in-force till the completion of entire policy term opted.

[**] Start at ₹500/ month: The premium for a 35-year-old healthy salaried male for a life cover of ₹ 63,217 for a policy term of 7 years, and premium paying term of 7 years is ₹ 500 p.m. assuming that all premiums (excluding applicable taxes, cesses and levies and rider premiums, if any) have been paid as and when due. The annualized premium for above parameters will be Rs. 5747 p.a.

[!] The return has been on a annualized premium for a 30 years old, healthy male, for an annualized premium of ₹60,000 for a PT of 20 years and PPT 8 years, provided that all premiums (excluding applicable taxes, cesses and levies) have been paid as and when due and the policy is in force till maturity.

iInvestII -

Bandhan Life iInvest II (UIN - 138L089V01) is an online, unit-linked non-participating individual life insurance savings plan. Life insurance cover is available under this product. IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS BORNE BY THE POLICYHOLDER. THE LINKED INSURANCE PRODUCT DO NOT OFFER ANY LIQUIDITY DURING THE FIRST FIVE YEARS OF THE CONTRACT. THE POLICY HOLDER WILL NOT BE ABLE TO SURRENDER/WITHDRAW THE MONIES INVESTED IN LINKED INSURANCE PRODUCTS COMPLETELY OR PARTIALLY TILL THE END OF THE FIFTH YEAR. Unit-linked life insurance products are different from the traditional insurance products and are subject to risk factors.

[!] Premiums paid in unit-linked life insurance policies are subject to investment risks associated with capital markets, and NAVs of the units may go up or down, based on the performance of the fund and factors influencing the capital market and the insured is responsible for his/her decisions. Please make your own independent decision after consulting your financial or other professional advisor. The performance of the managed portfolios and funds is not guaranteed and the value may increase or decrease in accordance with the future experience of the managed portfolios and funds.

Bandhan Life Insurance Limited is only the name of the Life Insurance Company and Bandhan Life iInvest II Plan UIN - 138L089V01 is only the name of the unit-linked life insurance contract and does not in any way indicate the quality of the contract, its future prospects or returns. Please know the associated risks and the applicable charges from your insurance agent or intermediary or policy document issued by us.

Life Insurance cover is available in this plan. For more details on risk factors, terms & conditions please read sales brochures and benefits illustrations carefully before concluding a sale. Issuance is subject to board-approved underwriting policy.

Unit Linked Life Insurance products are different from traditional insurance products and are subject to risk factors.

Buying a Life Insurance Policy is a long-term commitment. An early termination of the policy usually involves high costs and the surrender value payable may be less than all the premium paid.

Various funds offered under this contract are the names of the funds and do not in any way indicate the quality of these plans, their future prospects and returns

[“] An amount equal to total of premium allocation charges deducted (excluding taxes) in the policy during the policy term will be added back to the Base Fund value at the end of the 10th policy year provided all the due premiums have been received and is only applicable for policies which are sold through offline channel. No Allocation charges would be deducted from the policies sold through direct channel.

Group Term Plus -

Bandhan Life Group Term Plus Insurance Plan (UIN: 138N062V01), a non-linked non-participating one year renewable group term life insurance plan. Life insurance cover is available in this plan. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale. Insurance Issuance is subject to board approved underwriting policy.

Group Health -

Bandhan Life Group Health Plan (UIN: 138N063V01), a non-linked non-participating one-year renewable group health insurance plan. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale.

Group Credit Protection -

Bandhan Life Group Credit Protection Insurance Plan (UIN: 138N079V01) is a non-linked, non-participating group pure risk premium credit life insurance plan. For more details on risk factors and terms & conditions, please read the Sales Brochures carefully before concluding a sale. Insurance Issuance is subject to board approved underwriting policy.

Akhil Bharat Term Plan -

Bandhan Life Akhil Bharat Term Plan (UIN: 138N086V01) is a Non-Linked, Non-Participating Individual Pure Risk Premium Life Insurance Plan. For more details on risk factors and terms & conditions, please read the sales brochure carefully before concluding a sale. Life insurance cover is available under this product. Insurance Issuance is subject to board approved underwriting policy.

[@] Daily premium of ₹6/ day: The annualized premium of ₹2000 (₹5.48/ day, exclusive of taxes) has been calculated for a healthy, non-smoker male, aged 30 years, for a sum assured of ₹5 Lakhs, policy term of 10 Years, and premium payment term of 10 years.

Insta Pension -

Bandhan Life Insta Pension Insurance Plan (UIN:138N011V02), is a non-linked non-participating individual immediate annuity plan. Life insurance cover is available in this plan. Insurance Issuance is subject to board approved underwriting policy. For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale.

[3] Annuity will be payable in arrears. The frequency of annuity payments can be monthly, half-yearly, quarterly or annually as chosen by the annuitant at the time of purchasing the annuity. The annuity amount chosen at policy inception is guaranteed for life.

[2] The Annuity Benefits depends upon the Annuity Option and mode of annuity payment chosen by the annuitant and annuity rates prevailing at the time of purchase of the annuity, will be paid to the annuitant(s).

[*] T&C Apply

Bandhan Life Insurance Limited (formerly Aegon Life Insurance Company Limited), IRDAI Reg. No. 138. Corporate Identity No: U66010MH2007PLC169110. Registered Office: Bandhan Life Insurance Limited. A – 201, 2nd Floor, Leela Business Park, Andheri-Kurla Road, Andheri (E), Mumbai – 400059. Tel: +91 226118 0100, Toll Free No.:1800 209 90 90 (9 am to 7 pm, Mon to Sat),

Email: customer.care@bandhanlife.com. Website: www.bandhanlife.com. ADVT No. II/Oct 2024/7247